Product leaders face a daunting challenge: driving consistent, sustainable growth in increasingly competitive markets.

Despite many growth strategies and frameworks available, many companies struggle to meet their long-term growth objectives.

As a product leader, you’ve likely encountered these all-too-familiar scenarios:

- A database of ideas but uncertainty about which ones to prioritize

- New product launches that fall short of expectations

- Growth initiatives that struggle to secure adequate funding

These are symptoms of a deeper problem: outdated or ineffective growth strategies that rely on vague variables and broad generalizations.

But what if there was a simpler, more effective way to drive innovation and fuel growth?

Enter the Market Strategy Matrix – a revolutionary approach designed by innovation expert Tony Ulwick that cuts through the complexity and provides a clear roadmap for product-led growth.

Based on the principles of jobs theory and Outcome-Driven Innovation, this model offers a structured framework that will transform how you identify, evaluate, and pursue growth opportunities.

In this article, we’ll explore how the Market Strategy Matrix can help you:

- Categorize each potential opportunity according to stable market criteria into its type of growth (core, adjacent, or new).

- Provide a logical and simple framework to construct a growth strategy.

- Identify market opportunities and associated risks.

- Align the organization with a common framework for understanding customer needs that drive short-, medium–, and long-term growth.

Are you ready to simplify your approach to growth and unlock your product’s full potential?

Let’s dive in.

The Limitations of Traditional Growth Models

Before we delve into the Market Strategy Matrix, it’s crucial to understand why traditional growth models often fall short.

Classic models are ineffectual because they use broad or vague variables to guide strategic decisions. The primary variables of these models are time and solutions. Take, for example, the McKinsey three-horizon model, which is a time-based growth model.

Time is an input (constraint) to strategy; it is not the guiding determinant of a growth strategy. Time helps people think about planning for the future but gives little guidance on what the company should do.

Other models, like the one shared in the HRB article “The 6 Ways to Grow a Company,” are anchored in solution space. Ultimately, every growth strategy will include new products or services to achieve growth goals.

However, because the model is solution-oriented (vs. customer-problem-oriented), it gives little guidance on where or how to uncover new opportunities. Solutions are not stable variables/inputs for growth planning; they are the output of good strategy.

Companies that use these traditional frameworks see a general improvement in organizational awareness of the importance of building a growth portfolio without achieving a clear direction for creating an actionable growth strategy. Consequently, the overall growth improvement is minimal.

Introducing Market Strategy Matrix

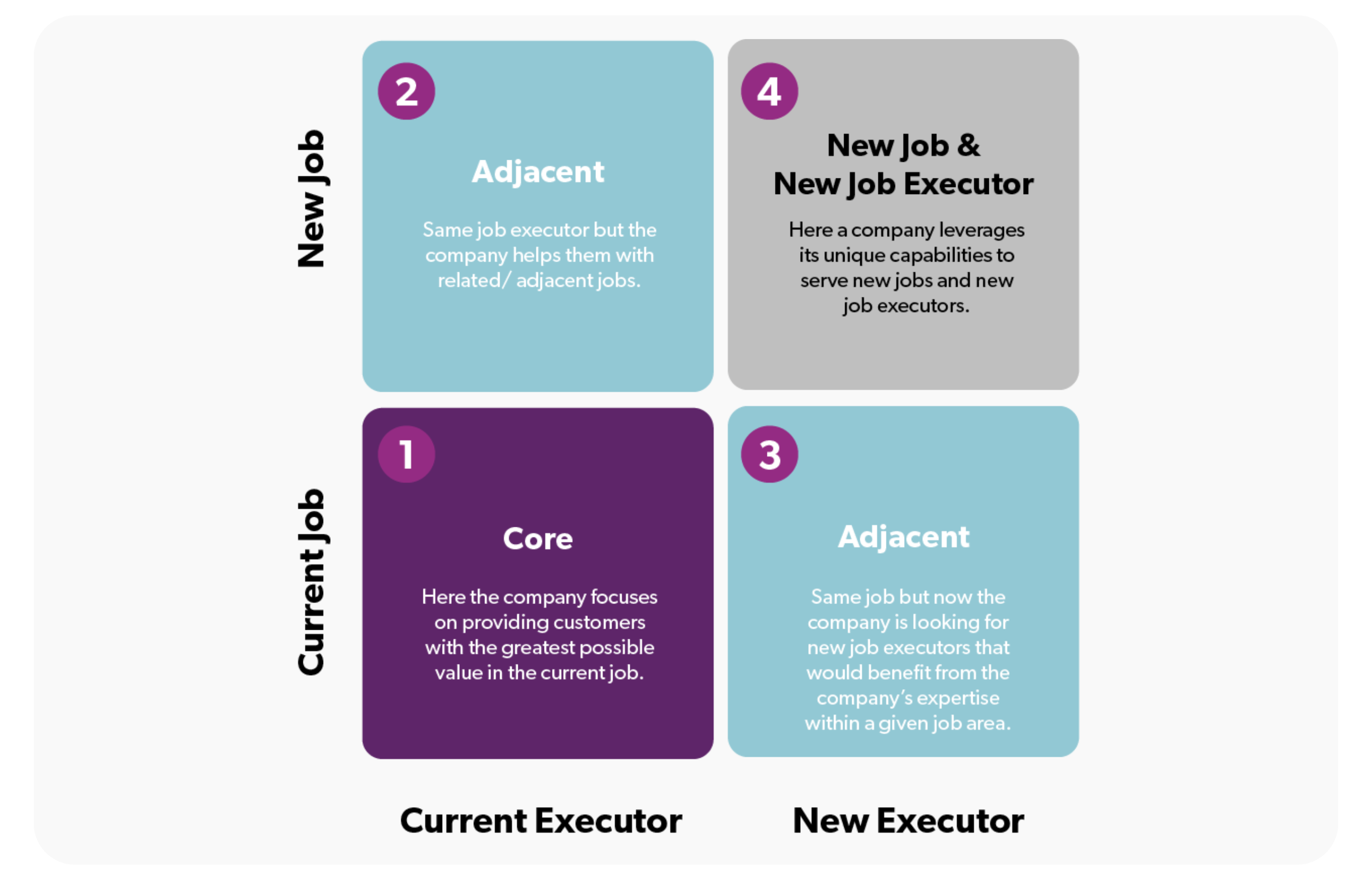

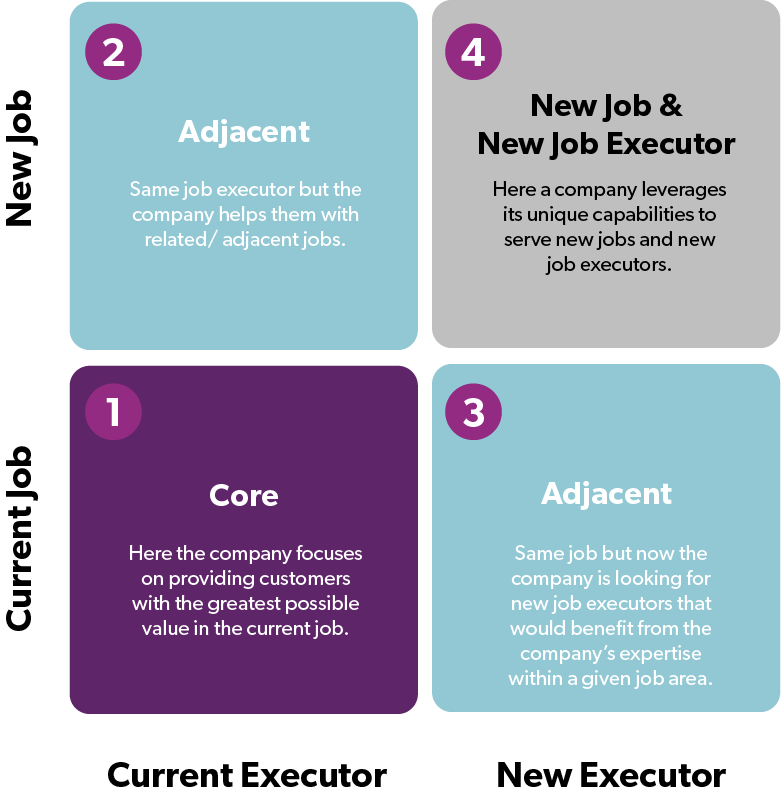

The Market Strategy Matrix simplifies growth by basing it on the two fundamental elements of any market:

- The customer (Job executor)

- Their job to be done

This approach makes categorizing and understanding each growth strategy and its related risks easy. By changing one or more of these elements for each type of growth, you can determine each strategy’s associated risk and potential benefit.

Let’s explore each type of growth.

The Four Quadrants of Growth

Quadrant 1: Core Market Growth (Core Job Executor, Core Job)

The first growth quadrant is to grow in your core market. In a core market, the company provides solutions to help a job executor get a functional job done. When companies are big and diversified, they can have multiple core markets. These markets are where companies spend most of their growth strategy effort.

Core markets represent the least risk to the business and offer the most significant short-term opportunity for continued growth. Jobs’ theory, and specifically, Outcome-Driven Innovation, is unique in its ability to unlock value in markets through its deep and precise capture and measurement of customer outcomes (needs).

Example:

Let’s consider a hypothetical company, Investment Software Inc. (ISI), which serves hedge fund managers.

In the core growth quadrant, ISI would focus on improving its software to help hedge fund managers build and manage investment portfolios to achieve specific investment objectives (their core job-to-be-done).

Using this example, ISI understands all of the outcomes (needs) that hedge fund managers are trying to achieve and continuously tries to improve customer satisfaction for each outcome. These needs (outcomes) are measurable and, through quantitative analysis, will indicate whether the company should continue to aggressively pursue growth in the core market (i.e., will it help them achieve their growth goals).

Because framing a market around the customer’s job-to-be-done is broader than a product view of a market, new opportunities are often discovered in what companies often think is a mature market. For more on the mature market fallacy, see this article.

Quadrant 2: Adjacent Market Growth (Same Core Job Executor, New Job)

The second growth quadrant (upper left) is helping the same job executor (as in the core market) but with related jobs-to-be-done.

Since the company already serves this job executor, finding additional, related jobs represents a logical place to extend a company’s value creation efforts. This growth represents lower market entry risk through leveraging existing relationships.

Example:

To continue the example above, ISI looks for related jobs that the hedge fund manager needs to accomplish.

For example, hedge fund managers often devise new investment theses. Before building a portfolio around the thesis (their core job), they must validate the thesis and see how it performs given assumptions and different market conditions.

This job is related to the core job, which precedes the actual portfolio construction. ISI has internal tools for developing and testing financial models within its software that it believes will help hedge fund managers model a new investment thesis.

Since ISI has already called on these hedge fund managers and they have an existing relationship with them, this is the next logical quadrant to pursue growth.

Quadrant 3: Adjacent Market Growth – (New Job Executor, Same Job)

The third growth quadrant (lower right) is to help a new job executor with the same core functional job in quadrant one.

The goal here is to find new job executors who need help with the same core functional job (or something very similar). This introduces more go-to-market risk as there are no current customer relationships to leverage—a new channel for this job executor needs to be created.

Example:

In this example, ISI serves hedge fund managers who invest for institutional clients. However, some of the hedge fund clients, like pension funds, university endowments and philanthropic organizations may want to build and manage their own portfolios. The needs of these clients may not be as sophisticated as those of a hedge fund manager, but they are very similar. ISI can develop and sell a more limited solution for this new job executor.

Quadrant 4: New Market Growth (New Job executor, New Job)

The fourth growth quadrant is in the upper right.

In new market growth, a company takes a unique capability and repurposes for serving a new market. Here, the company is changing both market variables, the job executor and their job-to-be-done. There is no existing product or relationship with the job executor, this is truly a new market. Quadrant 4 is the riskiest of the quadrants but has the potential for the greatest market growth.

Example:

Extending the ISI example, the company’s software uses unique and powerful risk algorithms to model risk within investment portfolios. These risk algorithms may be a source of value beyond traditional investment professionals. ISI might modify these underlying risk algorithms and repurpose the technology to identify risks in non-investment areas.

So instead of serving hedge fund managers or corporate institutional investment professionals, ISI can create risk-based software solutions to help an entirely new job executor get a new job done. For example, they can serve corporate risk managers as they do their job of identifying and quantifying financial risk within the business. Note, corporate risk managers are already doing this job of identifying and quantifying financial risk within the business; they are just using other solutions. ISI in this case will apply its sophisticated risk technology to serve a new job executor doing a new job.

Implementing the Strategy Matrix

As a product leader, here’s how you can start using the Matrix to drive growth in your organization:

- Identify Core Markets: Identify the core functional job and job executor for each of your current markets.

- Assess Market Opportunities: For each quadrant, hypothesize market opportunities using the Market Growth Matrix variables.

- Evaluate Risks and Resources: Assess the risks and required resources associated with pursuing opportunities in each quadrant.

- Prioritize Initiatives: Based on your growth goals, risk tolerance, and available resources, prioritize which market strategies to explore further through research. De-risk the strategy by doing Outcome-Driven Innovation research for the market strategy chosen.

- Align Your Organization: Use the matrix to communicate your growth strategy across the organization, ensuring that all teams understand how their efforts contribute to the overall growth plan.

- Monitor and Adjust: Regularly review your progress in each quadrant and be prepared to adjust your strategy based on market feedback and changing conditions.

We have listed the order in which to pursue growth, providing the fastest path to growth at the lowest level of risk. We acknowledge, however, that this decision will be context-dependent and based upon a company’s unique market conditions and goals at the time of decision. We help companies navigate that decision process based on their goals, capabilities, and market conditions.

Note: We did not include business model changes in our Growth Matrix for a reason. While a business model change is an element of the overall customer experience, it is not the primary driver of customer value creation. Business model innovation is a topic better understood through the lens of the customers’ consumption and buying needs, which are beyond this article’s scope.

Summary

Unless a company is a startup, it has a history of creating value in its markets along two major stable dimensions: the job executor (who the company serves) and a job-to-be-done (what the company helps the job executor with).

The core market is the starting point of building a growth strategy. The two critical criteria of job executor and job-to-be-done can be changed to identify new areas for growth in a systematic, logical, and risk-defined way. Growth models don’t have to be complicated to produce results. In fact, simple is better!

In coming articles, we will explore this model further, covering these topics:

- How to gain market insights to innovate in each quadrant

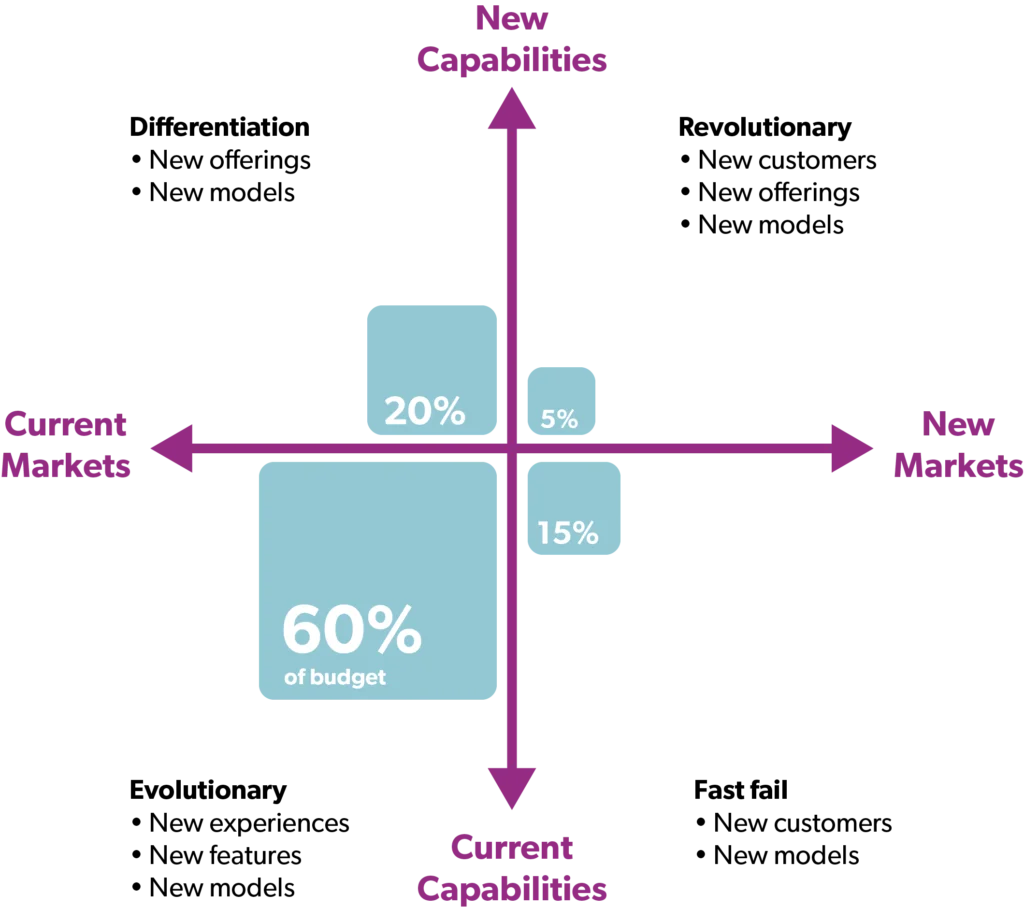

- What percentage of growth should a company pursue in each quadrant