Financial services has become a commodity

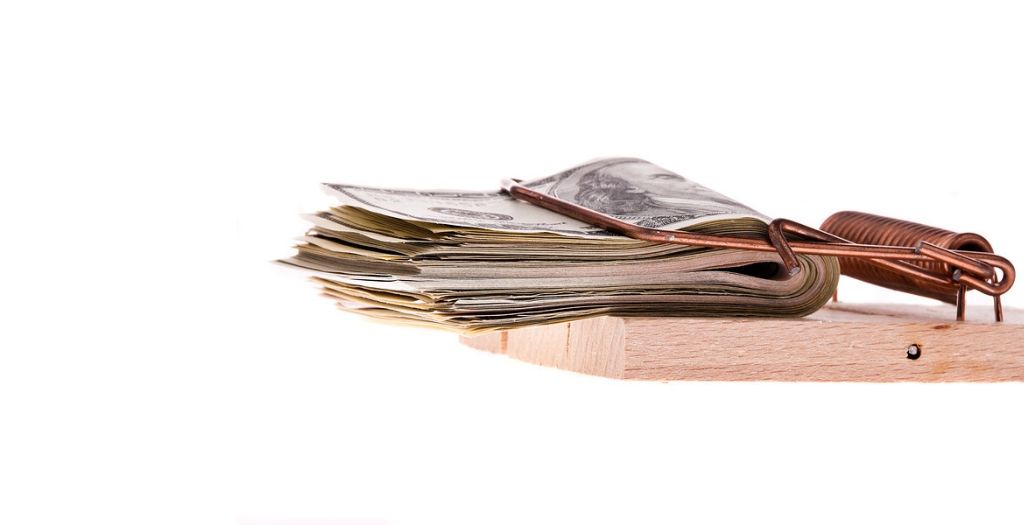

In our recent blog we highlighted profit and growth challenges in the healthcare industry. This time we will focus on financial services. Like the healthcare industry, financial services companies face the challenges of profitability and growth while trying to cut cost and risk. From the customer perspective, financial products and services have become increasingly non-transparent, making it almost impossible for customers to find out if an offering is going to fit their needs. Consequently, the price and conditions of said offerings have become the main purchasing criteria, especially in private banking. Products with limited room for differentiation on anything other than price, force providers of financial services to tap into the commodity trap. This means that lowering prices is the only way to compete. Providers can escape this trap using jobs-to-be-done thinking.

Product management is challenged by the commodity trap

Product managers in general face three major questions on how to get out of the commodity trap and find new products that achieve both profitability and market share growth:

- What generates additional value for our clients?

- What causes unnecessary cost/inefficiencies in the product and in its usage?

- How can we be sure that the final product will work in all target markets (segments) and contexts?

In our last article, we demonstrated how to create additional value by understanding the true customer needs. This article focuses on the second question. Imagine you’re a product manager for a financial services company. How would you cut unnecessary costs and inefficiencies while delivering superior customer value at the same time?

A different viewpoint: jobs-to-be-done thinking

Traditional banks offer personal advisories that aim to support clients with all their financial tasks. In exchange for their services, they charge fees – monthly debit card fees, account maintenance fees, low balance fees, overdraft fees and so on. When Joshua Reich, Shamir Karkal and Alex Payne founded the banking service Simple, they looked at the whole banking process from a different viewpoint. They realized that customers do not want to do the job of making transactions, checking their bank account balance or finding out which is the right saving product for them. Instead, the job customers want to get done is to hire a financial service product to manage their finances. This viewpoint is what we call job-based thinking.

With this conceptual model in mind, and pooling their experiences from technology industries, the founders created a banking service that focuses on helping customers manage their finances in a never before reached grade of simplicity and comfort. Simple is not a bank. Instead, it cooperates with other banks to handle all of the typical banking chores and focuses on building a better banking customer experience. It gives customers instant access to purchase data, both online and through apps, allows them to plan their budget, and set up and track their savings goals. Customers can automatically put a certain amount of funds towards their goals every month or analyze their spending and saving behavior through extensive reports.

“The real hope with these features is that we could do something that people have been trying to do, but that’s been difficult to do,” said Joshua Reich, founder and Chief Executive of Simple, in an interview with VentureBeat. The customers agree. Just one year after its official launch, Simple announced that it is processing more than $1 billion in transactions per year. Clearly using this product is helping customers get their banking jobs done better.

With its well thought out and appealing design, the service platform Simple can reduce customer service staff and save on costs like facilities and bank accounts. At the same time, it offers superior customer value by getting the customers job of “managing finances” done better and easier than other banking providers.

Studies show that depending on the industry, up to 60% of people are willing to pay more for simpler experiences and interactions. For simpler experiences, people would pay up to 5.5% more in General Insurance and up to 6% more in Retail Banking. Job-based thinking helps companies to identify true customer needs and develop concepts that clearly target these customer needs. This reduces additional costs and inefficiencies in the product and in its usage. Looking at the jobs-to-be-done rather than simply lowering prices can turn one product into an entirely new market, all while avoiding the commodity trap.

Part 3 in this series will discuss how to escape the commodity trap in the building and construction industry. Read Part 1 here.