Whether or not it’s an “official” recession, we’re in the midst of tough economic times. Most businesses are feeling the pinch — and cutting the fat.

But then what?

Do you sit around with your fingers crossed and wait for better days ahead? Harvard Business Review explains that the companies most likely to come out of a recession on top are those that cut judiciously — while also investing in new opportunities. You need to redeploy resources so you’re ready to competitively come out of the gates when the market rebounds.

When you view a recession this way, it becomes an opportunity instead of a challenge.

The tricky part is identifying and investing in the right opportunities to set you up for future success.

4 approaches to surviving a recession

As HBR explained in 2010:

“Great leaders know that how they fight a war often decides whether they will win the peace. Yet as CEOs continue to combat the myriad challenges thrown up by the Great Recession of 2007, they are increasingly unsure about what strategic approaches to deploy.”

The same holds true today, but this time, we have HBR’s research to guide us out the other side.

Authors Ranjay Gulati, Harvard Business School, Nitin Nohria, Harvard Business School, and Franz Wohlgezogen, then a doctoral student at Northwestern University’s Kellogg School of Management, spent a year studying and analyzing strategy selection and corporate performance during the prior three global recessions:

- The 1980 crisis (1980 to 1982)

- The 1990 slowdown (1990 to 1991)

- The 2000 bust (2000 to 2002)

They studied 4,700 public companies, breaking down the data into three periods: the three years before a recession, the three years after, and the recession years themselves.

At its simplest, the researchers found that businesses typically take one of four approaches to surviving a recession:

- Prevention-focused companies make primarily defensive moves, like cutting costs and improving efficiencies. They are more concerned than their rivals with avoiding losses and minimizing downside risks.

- Promotion-focused companies invest more in offensive moves that provide upside benefits than their peers do, such as investing in talent, assets, or businesses .

- Pragmatic companies combine defensive and offensive moves.

- Progressive companies deploy the optimal combination of defense and offense.

Perhaps unsurprisingly, companies that take a progressive approach during a recession are mostly likely to surpass their competitors post-recession. Statistically speaking, 37% of these businesses will outperform their rivals by 10% or more on both top- and bottom-line growth after a recession. Compare that to pragmatic companies (29%), promotion-focused (26%) and prevention-focused (21%).

The researchers explain:

“These companies’ defensive moves are selective. They cut costs mainly by improving operational efficiency rather than by slashing the number of employees relative to peers. However, their offensive moves are comprehensive. They develop new business opportunities by making significantly greater investments than their rivals do in R&D and marketing, and they invest in assets such as plants and machinery.”

This all sounds well and good, but how do you know which investments are the right investments? And which ones should get the ax?

As we’ve discussed, most companies have a pipeline overflowing with ideas — they just don’t know which ones will be successful. HBR’s research shows that during a recession, it’s even more important to cut the waste and laser focus on your best opportunities.

Pinpoint your best investment opportunities

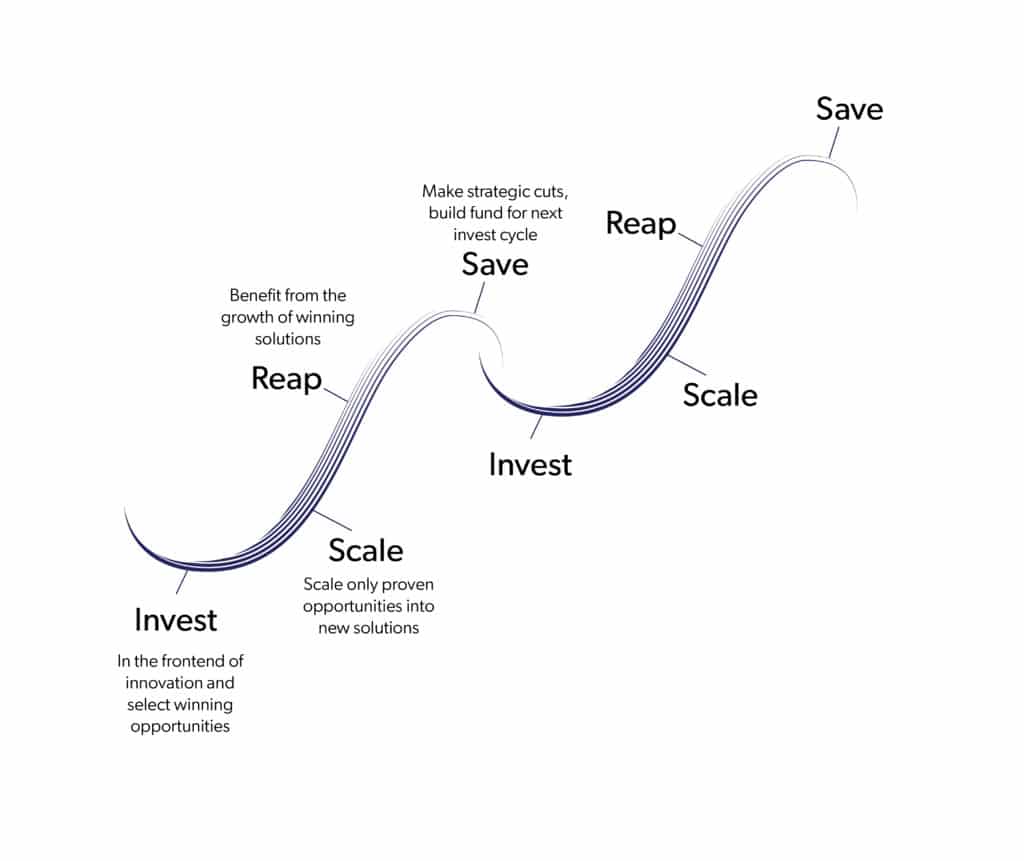

When you know specifically where to invest, you have the opportunity to come out of the recession years ahead of your competition. Outcome-Driven Innovation (ODI) is a data-driven framework for identifying where, exactly, to invest—and what efforts to deprioritize.

The ODI framework is based on Jobs Theory. It uses both qualitative and quantitative research methods, as well as statistical analysis, to:

- Identify—with precision—all of a customer’s needs in a given market

- Quantify and prioritize which of those needs represent significant opportunities for growth

- Create concepts around those opportunities that you know will win in the market

- Develop a go to market strategy that provides the most efficient path for growth

In other words, the output of ODI is a prioritized list of unmet customer needs that tells you exactly how to add value for specific sets of customers. It’s like a rubric to evaluate your pipeline, allowing you to choose investments opportunities with confidence — and cut others without any FOMO.

We have a client in the pharmaceutical space, for example, working to help patients with the job of managing a neuromuscular disease. With digital transformation of healthcare underway, many leading pharma companies are looking to add value through digital tools that accompany their more traditional solutions.

Our client had plenty of ideas for using technology to better manage a neuromuscular disease — but they didn’t know which ones to pursue. Using Outcome-Driven Innovation, they were able to see exactly where patients struggle with this job-to-be-done and where a digital solution could help people get the job done better.

ODI allowed this client to confidently double down on investment in these key areas, while killing many of their other projects.

It’s time to build…strategically

You don’t buy stocks when they’re expensive — you buy them when they’re cheap. This sets you up for significant growth when the market grows. Similarly, you want to strategically invest in and build your business during economic slowdowns.

But at a time when you’re already more risk-averse, you don’t want to gamble more than you have to on these investments.

Invest in the front-end of innovation with Outcome-Driven Innovation to see exactly where you should invest — and which projects to nix. Prioritize your investments with confidence, and you’ll come out of the recession ahead of the competition.