Market segmentation (also referred to as customer segmentation) is the process of discovering groups of customers that have different unmet needs. An effective market segmentation process forms the foundation for a winning market strategy as it reveals how and why customers are different and pinpoints what unmet needs customers are looking to satisfy with new products and services. Using Strategyn’s outcome-based market segmentation methodology, a company is able to identify underserved and overserved customer segments, determine which needs are unmet in each segment, and determine the degree to which they are unmet.

Our methodology works because it is focused on understanding the “job” the customer is trying to get done and uses the customer’s unmet desired outcomes (a special type of need statement) as the basis for segmentation. The insights resulting from this approach make it possible to surgically formulate a market strategy in any market that will lead to growth.

Success in marketing is dependent on applying solid market segmentation theory. Targeting a market segment that satisfies the basic tenets of solid segmentation theory (e.g., the population agrees on what they value) dramatically increases the chances that a product or service will succeed, as it is more likely to connect solidly with the target customers.

Despite the importance of getting market segmentation right, many managers continue to adopt demographic, psychographic, behavioral, and/or attitudinal market segmentation schemes that squarely target their products and services at phantom targets—segment classifications that are imposed on customers but in reality do not exist. When applying faulty market segmentation theory, companies experience many failed product and service efforts.

Company managers know they are looking for customers with different unmet needs, but there is a problem: in most companies, managers can’t agree on what a customer need even is, or on what all those needs are. Unfortunately, companies have come to believe that it is impossible to know all their customers’ needs. So how can they segment their markets around customer needs? With this thinking, they can’t. And this is why they struggle to innovate.

Our market segmentation methodology works because it is built around a solid definition of what a customer need is. As we look at market segmentation through a jobs-to-be-done lens, we have discovered that customers consider between 50 and 150 metrics (their desired outcomes) when assessing how well a product or service enables them to successfully execute any job. These desired outcomes are the customer’s needs. They are the key input into our innovation process, Outcome-Driven Innovation (ODI).

We have discovered that the reason segments exist in the first place is that people encounter varying levels of complexity and struggle differently when executing the job-to-be-done. We have also discovered that in most markets it is likely to find one or more segments that are underserved while also having segments that are overserved. Our methodology also reveals the most profitable segments: those that will pay the most to get the job done best. Knowing the size of each segment, what outcomes are unmet in each segment, and how much those in each segment are willing to pay to get the job done better is our secret to formulating an effective growth strategy.

To examine our market segmentation methodology, let’s consider the following market segmentation example: Motorola’s Radio Products Group manufactures mobile radios that are installed in vehicles and used to communicate with a dispatcher, a central location or other two-way radio users. After experiencing limited growth in what appeared to be a maturing market, Motorola looked for new ways to achieve their growth objectives.

For years, Motorola had been using a vertical industry classification to segment the radio market, e.g., utilities, public services, etc., and often recognized the inconsistencies in customer behavior within and across these segments. Intuitively, they knew another segmentation structure existed, but were unable to define it. The application of our outcome-based segmentation methodology enabled Motorola to discover the existence of three unique and previously unknown segments. One segment, which comprised 40% of the market, “hired” radio products to communicate privately, so as to not be overheard and to communicate discreetly or covertly, without being noticed by others. A second segment in this market segmentation example (28%) “hired” radio products so they could communicate with clear, unambiguous and uninterrupted communications when faced with dangerous, even life-threatening situations. The third segment (32%) “hired” radio products to communicate with teams and groups, coordinating activities and performing administrative tasks.

Up until this point, all products produced by Motorola, and its competitors, failed to address the outcomes uniquely desired in each segment with well-matched product and service offerings. A one-size-fits-all mentality perpetuated the industry. With the discovery of these segments, Motorola was able to optimize a radio product for each segment. The products included new features that addressed outcomes previously underserved and eliminated product features that addressed outcomes of little or no importance to the segment population.

The end result of this market segmentation example? Better products, at a lower price, with increased customer satisfaction. The resulting products accelerated revenue growth to 18% in a stagnant market, and secured the company’s leadership position in mobile radio products.

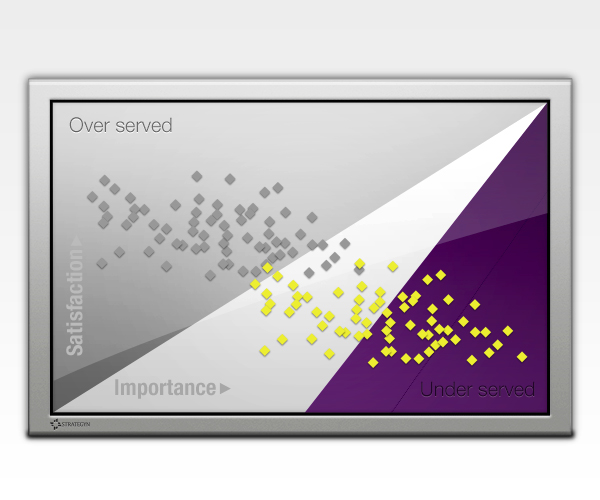

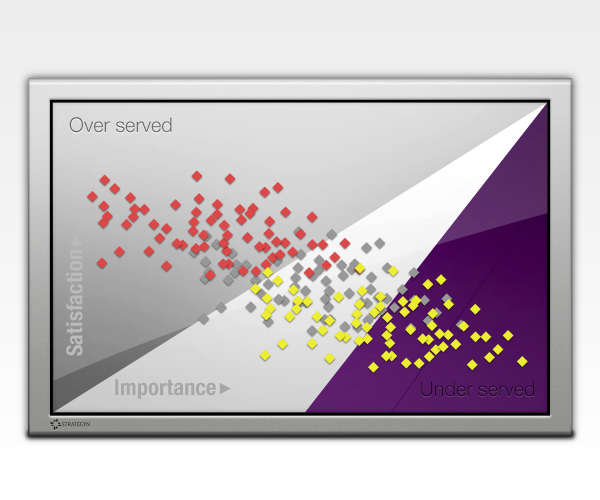

An effective market segmentation strategy reveals the dynamics of a market. Our Opportunity Landscape has proven to be an invaluable tool for helping us visualize those dynamics and the degree to which market segments are over- and underserved. A landscape is a snapshot of all the customers outcomes in multiple segments. Each dot in the landscape represents the degree to which a specific outcome is important to the customer and the customer’s level of satisfaction. The different-color dots represent different segments. We discover unique segments of opportunity by segmenting markets around customer outcomes. Using these insights, a company is able to formulate a market segmentation strategy that will guide and inform its growth. Learn more about our growth strategy consulting services.

This landscape reveals a market that consists of two segments: one that is underserved and one that is overserved. Each segment requires a different product strategy. The underserved outcomes represent opportunities for growth.

This landscape reveals a market that consists of three segments. Knowing these segments exist is customer insight that competitors are unlikely to have.

Giving Customers a Fair Hearing

In this provocative article in MIT Sloan Management Review, Tony Ulwick and Lance Bettencourt introduce timeless standards for helping you understand the types of customer needs that exist and how we use them to segment markets and create customer value.

Download the article

Outcome-Based Marketing Segmentation

Our outcome-based market segmentation methodology, described here by Strategyn founder Tony Ulwick, offers a better way to segment markets and formulate growth strategies. Using customer desired outcomes (needs) as the basis for market segmentation, we helped Motorola discover unique segments of opportunity and hidden revenue streams.

Download the white paper

What is Outcome-Driven Innovation?

Outcome-Driven Innovation (ODI) is the most effective innovation process in existence today. This white paper by Strategyn founder and ODI inventor Tony Ulwick explains why innovation has historically been an ineffective process, the discoveries he made that led to ODI, and how ODI enables us to segment markets and accelerate company growth.

Download the white paper

Silence the Voice of the Customer

This white paper by Strategyn founder Tony Ulwick highlights the business advantages of using our ODI methods to capture and prioritize customer needs. It explains why traditional voice-of-the-customer (VOC) practices continue to fail and makes a solid case for retiring VOC as a method for understanding customer needs.

Download white paper

What Customers Want

What Customers Want, the best seller by innovation thought leader Tony Ulwick, explains what Outcome-Driven Innovation (ODI) is and why it works. Ulwick, who pioneered jobs-to-be-done thinking and invented ODI, details how ODI transforms jobs-to-be-done theory into a practical method for market segmentation and an effective process for innovation and growth.

Learn More

Copyright ©2024 Strategyn LLC. All Rights Reserved. | XML Sitemap | HTML Sitemap